The economic inflation affecting everyone’s wallet have forced

United to address the need for a rate adjustment to continue

providing exceptional service and value to the membership.

by

JOHN DAVIS

The average American consumer need only go so far as the nearest grocery store to feel the effects of post-pandemic inflation.

Food and beverage prices have increased by more than 22 percent between 2020 and 2024, according to the U.S. Bureau of Labor Statistics, increasing an average of 5.17 percent a year during that period.

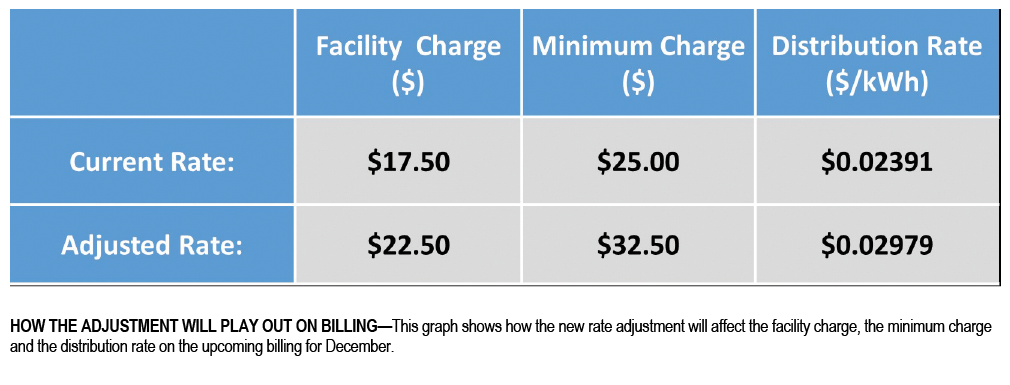

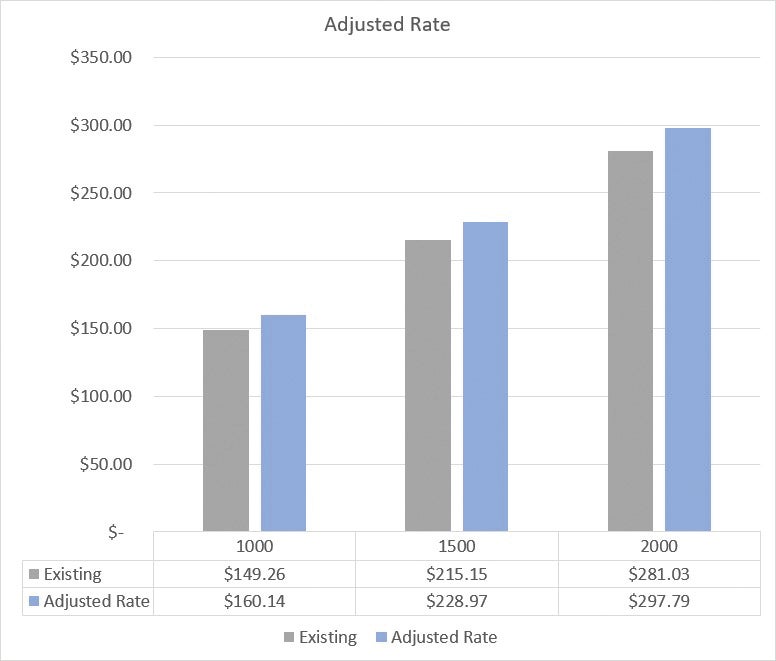

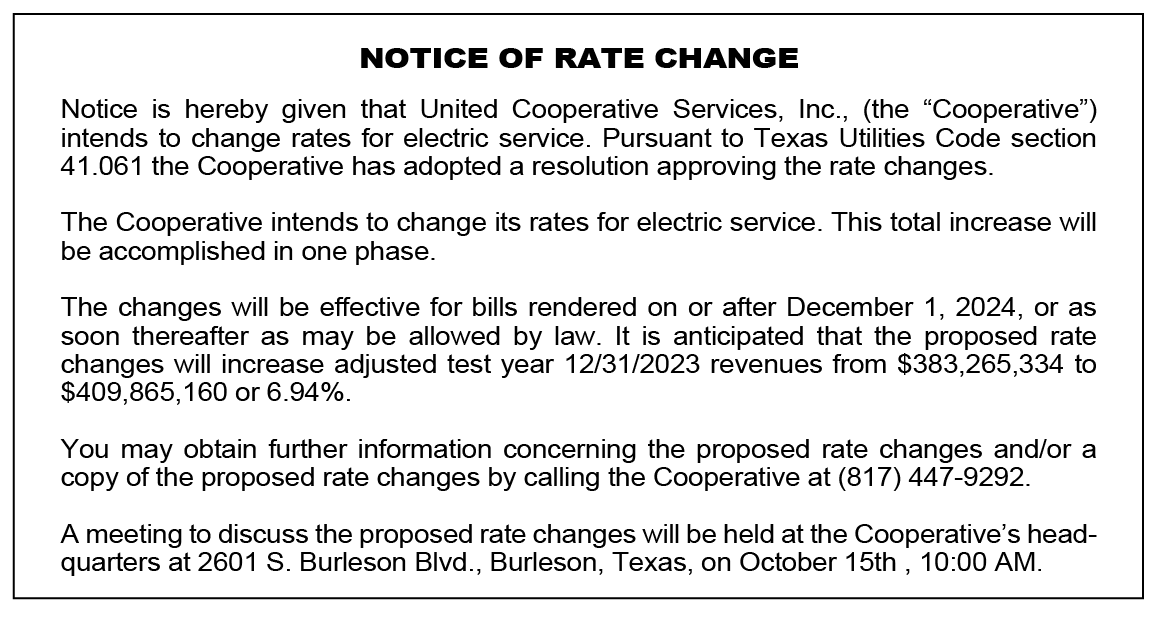

Subject to the same effects of economic inflation that all consumers experience, United Cooperative Services will have to implement a 6.94 percent overall rate adjustment to keep up with ratcheting cost increases to the supplies that keep the co-op’s electric system in reliable working order for a population that continues to swell within the co-op’s service territory and statewide.

Members will see the new rate structure take effect in November and appear on their December bills. The average residential member bill will see an increase of $14.

“Though United prides itself on planning ahead, no one could have predicted the global pandemic, Winter Storm Uri or their economic impacts,” said United CEO Cameron Smallwood. “These events and today’s high interest rates have shaped the economy we see today for consumers and businesses alike. Just as members are seeing these impacts on their daily cost of living, the price for the products we use to keep United’s electric infrastructure in working order have skyrocketed in the past few years. In order to continue to provide the exceptional service and value our members have grown to expect, we had to revisit United’s portion of the bill and consider making a rate adjustment to keep up with the inflation affecting everyone and everything.”

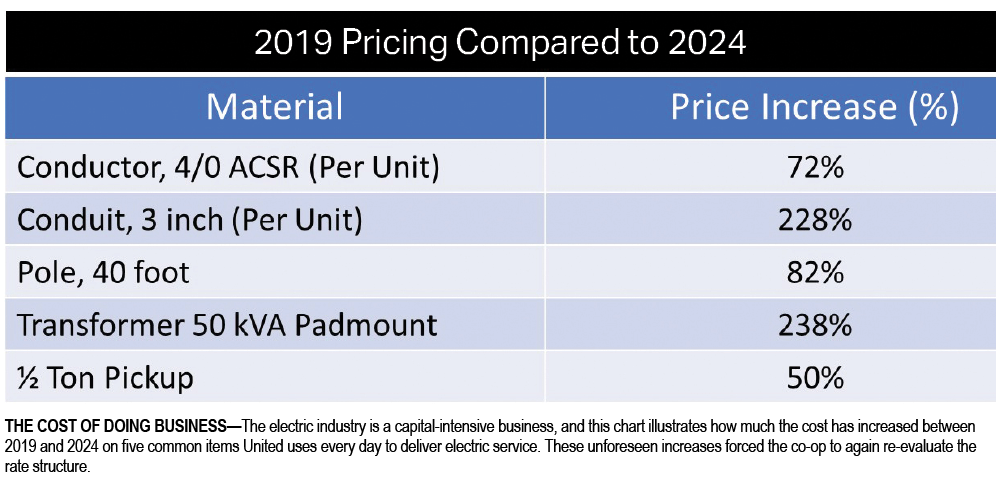

Smallwood said United last made a rate adjustment in 2021 using data from 2019 expenses and a forecast of cost inflation using reasonable estimates at that time. That cost-of-service study estimated 2021’s adjustment could have sufficed until potentially 2026. However, the drastic increase in inflation, compounded by meter growth at levels United hasn’t experienced since the late 1990s, shortened the window in which rates were adequate to cover operating expenses.

The co-op currently serves more than 77,000 members and 106,000 meters.

“If everything goes according to plan, it looks like this rate adjustment should last us three to five years before we’ll have to talk about it again,” Smallwood said. “We’re trying to keep the increase small, and we’ve actually planned it a little below seven percent because we understand what the times are like right now for our members.”

Russell Young is United’s senior vice president of finance & accounting. He explained that when United adjusts its distribution rates, those rates are fixed until the next cost-of-service study is performed. Over time, cost inflation erodes margins to the point where they are no longer compliant with the financial goals and objectives of the cooperative, including requirements from United’s lenders.

As recent examples, he said, the cost of materials for the electric service, such as poles, transformers and conductors has increased in most cases from 75 percent to over 200 percent. For example, the cost of one of United’s most predominant transformers (50 KVa padmount) increased by 238 percent since the 2021 rate adjustment.

As a capital-intensive business, United relies on lenders to provide the capital to ensure that both members today and for generations to come benefit from a robust, reliable distribution system. Interest rates on loans United uses to pay for its expanding electric service have more than doubled since 2021, Young said. Without a rate adjustment, the cooperative would not be able to sustain the appropriate level of margins required by lenders.

Young emphasized that United’s high-speed internet’s service costs play no role in these increased expenditures seen in the electric business. While Texas Senate Bill 14 paved the way for electric cooperatives to use existing electric service easements to provide internets services, it also stipulated that electric rates could not be used to cover internet service costs.

“United has always maintained separate books and records for electric and internet services,” Young said. “None of the costs associated with internet service were included in the cost-of-service study performed in preparation for the rate adjustment.”

When inflation erodes the margins to the point the co-op can no longer meet its goals, Young said that an independent expert rate consultant facilitates the rate-adjustment process with input and guidance from a member advisory committee, composed of United members representing the seven districts of the co-op’s service territory.

The co-op will then make an adjustment that more accurately matches the revenue needed to support the cooperative’s true service delivery costs today. The new rate adjustment is projected to meet the cooperative’s operational cost expectations until 2028, or potentially 2029.

“The member advisory committee provided important feedback on a number of topics having to do with the cost-of-service study, rate adjustment, bill nomenclature and even bill format,” Young said. “I think that members of the committee appreciated the thoroughness of the study and the priority we put on rate fairness across the various rate classes (residential, irrigation, small commercial, large commercial). We sought their input especially when considering whether and how much to adjust the fixed and variable charges to achieve the required revenue increase. Ultimately, the middle ground approach of adjusting both types was agreed upon by all.”

The largest slice of a United member’s monthly electric bills—about 70-80 percent of most residential bills—is the cost of wholesale power United pays its power supplier (Constellation Energy), and passes along to members without markup (Power Supply Charge). The wholesale energy contract runs through the end of 2025, and United has already begun exploring what options are available to the cooperative of potentially reducing this at the end of the contract.

The remaining 20-30 percent of a residential bill consists of the delivery kWh usage component (delivery charge), and this covers the cost of:

- Operating expenses

- Costs for necessary replacement and maintenance of existing electric distribution facilities

- Costs for newly expanded electric distribution facilities

- Debt service coverage

- Maintaining sufficient margins to meet lending requirements

This remaining 20-30 percent of the bill (delivery charge) is where United members will see the increase, he said.

Rate increases are not the only way United fights rising costs. Management and the board of directors continually look for ways to operate more efficiently and keep costs down, and the cooperative has a long, successful track record in accomplishing these goals. For example, United electric employees serve 525 meters per employee while the median for U.S. cooperatives of like size is 514. Plus, United’s total operation and maintenance cost is $399 per meter while the median for cooperatives of like size across the nation is $417 and the median for Texas cooperatives is $548 per meter.

“Our market research has shown that many utilities, including cooperatives across Texas and the country, began implementing rate adjustments in 2023 due to the same inflationary cost pressures,” he said. “This trend has continued in 2024. It is unfortunate that we have had to revisit our delivery rate sooner than we expected. However, fiscal responsibility has required us to do so.”